Fraud Detection Regulation Oversight Tracking Network 3518280281 3922788771 3511287261 3669842780 3714910357 3292681250

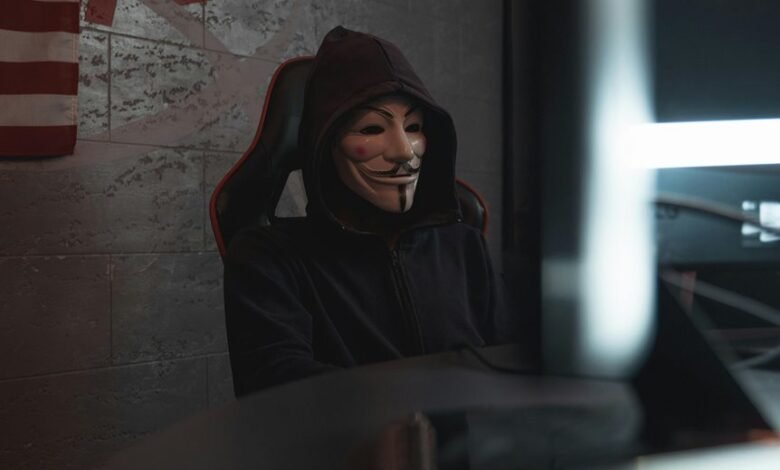

The Fraud Detection Regulation Oversight Tracking Network, represented by multiple identification numbers, serves as a pivotal framework for enhancing compliance with fraud detection laws. This network utilizes advanced technologies, including machine learning and real-time data processing, to identify fraudulent activities. Its implications for both consumers and businesses are substantial, raising questions about its effectiveness and future evolution in combating fraud. What challenges and opportunities lie ahead for this innovative approach?

Overview of the Fraud Detection Regulation Oversight Tracking Network

The Fraud Detection Regulation Oversight Tracking Network (FDRONT) serves as a crucial framework for monitoring and evaluating compliance with fraud detection regulations across various sectors.

Its network architecture facilitates seamless data exchange, ensuring that entities adhere to regulatory compliance efficiently.

Key Technologies and Methodologies Employed

Numerous advanced technologies and methodologies are employed within the Fraud Detection Regulation Oversight Tracking Network (FDRONT) to enhance its efficacy in identifying and mitigating fraud.

Machine learning algorithms analyze vast datasets, enabling real-time processing and adaptive learning. Anomaly detection techniques further identify irregular patterns, facilitating proactive measures against fraudulent activities.

Together, these innovations ensure a robust framework for maintaining integrity and transparency in financial transactions.

Benefits for Consumers and Businesses

While concerns about fraud can create apprehension among consumers and businesses alike, the implementation of robust fraud detection regulation oversight significantly enhances trust in financial systems.

This regulatory framework ensures consumer protection by mitigating risks associated with fraudulent activities, while simultaneously fostering business accountability.

Consequently, both parties benefit from increased security, leading to a more stable economic environment conducive to growth and innovation.

Future Implications for Fraud Prevention and Regulation Compliance

Robust fraud detection regulations set the stage for future advancements in fraud prevention and compliance.

Emerging future trends indicate a shift towards more proactive measures, utilizing artificial intelligence and big data analytics.

However, organizations will face regulatory challenges, necessitating adaptive strategies to ensure compliance while enhancing security.

Balancing innovation and regulation will be critical in safeguarding consumer interests and maintaining operational integrity.

Conclusion

In conclusion, the Fraud Detection Regulation Oversight Tracking Network stands as a pivotal advancement in combating fraud, utilizing cutting-edge technologies to enhance compliance and security. Notably, studies indicate that organizations employing such networks can reduce fraud-related losses by up to 50%. This statistic underscores the significant impact of proactive fraud detection measures, reinforcing the necessity for businesses to adopt these innovative solutions to safeguard their operations and maintain consumer trust in an increasingly complex financial landscape.