Fraud Detection Tracking Surveillance Protection Council 3477398529 3249016659 3511323328 3455158085 3483424096 3533134092

The Fraud Detection Tracking Surveillance Protection Council operates as a critical entity in the financial sector. It employs advanced technologies, such as machine learning and biometric authentication, to detect and prevent fraudulent activities. By fostering collaboration among various institutions, the council addresses the complexities of modern financial fraud. As it enhances transparency and builds trust, questions arise about the effectiveness and future developments of these measures. What implications do these advancements hold for consumers and institutions alike?

Understanding the Role of the Fraud Detection Tracking Surveillance Protection Council

The Fraud Detection Tracking Surveillance Protection Council serves a critical function in safeguarding financial ecosystems from fraudulent activities.

By implementing robust fraud prevention strategies, the Council enhances the resilience of financial systems. It employs advanced surveillance techniques to monitor transactions, identify anomalies, and thwart potential fraud.

This vigilance fosters trust and security, empowering individuals and businesses to engage freely within the financial landscape without fear of deception.

Innovative Technologies in Fraud Detection

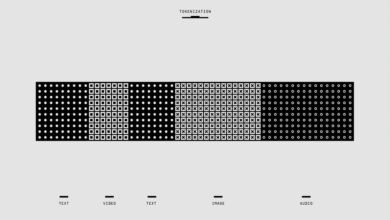

Advancements in technology have significantly transformed the landscape of fraud detection, complementing the efforts of organizations like the Fraud Detection Tracking Surveillance Protection Council.

Machine learning algorithms analyze vast datasets to identify patterns indicative of fraudulent activity, while biometric authentication enhances security by verifying identities through unique physical traits.

These innovations empower organizations to proactively combat fraud, ensuring greater safety and freedom for consumers.

Collaborative Efforts in Combating Financial Fraud

While individual organizations have made significant strides in fraud detection, collaborative efforts among financial institutions, government agencies, and technology providers are essential for a comprehensive approach to combating financial fraud.

Community partnerships foster stakeholder engagement, enhancing information sharing and resource allocation.

Such collaborations leverage diverse expertise and technologies, creating a robust defense against fraud, ultimately protecting consumers and maintaining trust in financial systems.

Enhancing Transparency and Trust in Financial Systems

Although financial systems inherently involve complexity and risk, enhancing transparency is crucial for fostering trust among consumers and stakeholders.

Promoting financial literacy empowers individuals to navigate these systems effectively, while stringent regulatory compliance ensures accountability.

Conclusion

The Fraud Detection Tracking Surveillance Protection Council exemplifies the critical intersection of technology and collaboration in combating financial fraud. By leveraging innovative machine learning algorithms and biometric authentication, the council not only enhances security measures but also fosters a culture of transparency and trust. This multifaceted approach addresses the complexities of modern financial ecosystems, effectively challenging the theory that fraud is an inevitable consequence of digital transactions. Ultimately, the council’s efforts contribute to a more resilient and secure financial environment for all stakeholders.